Debt Tracking

Manage your corporate financing operations

With Kls Desk's Debt Tracking application, you can streamline the collaborative management of debt tracking and exercise your role as principal banker by collecting, monitoring, sharing and adjusting contractual commitments in a single interface.

Current users

Join our community of modern Debt Trackers.

Productivity gain

Save 1 week / month / FTE

in managing your debt portfolio.

Platform disponibility

Over the last three years, our platform has experienced zero downtime, consistently exceeding our uptime guarantee.

A multi-interface SaaS platform

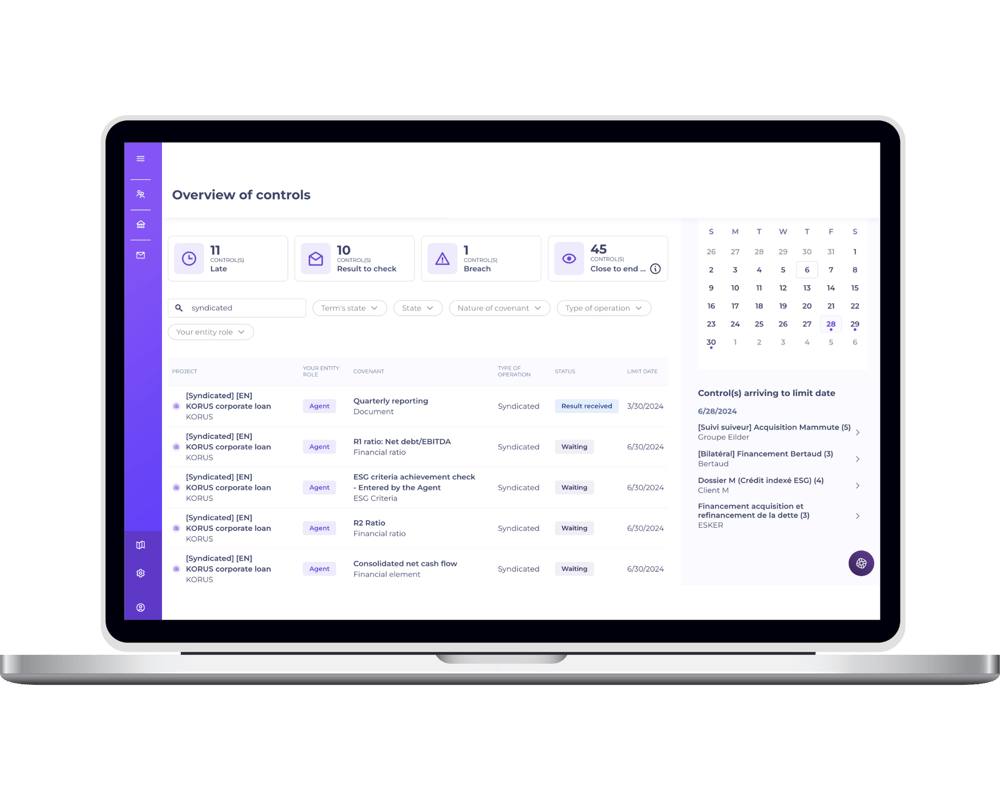

Risk Management

Debt Tracking allows corporate finance professionals to actively keep track of their entire private debt portfolio and measure their risks' exposure and forbearance.

Invite your internal and risks team to live monitor your operations and/or export the right data in 1-click.

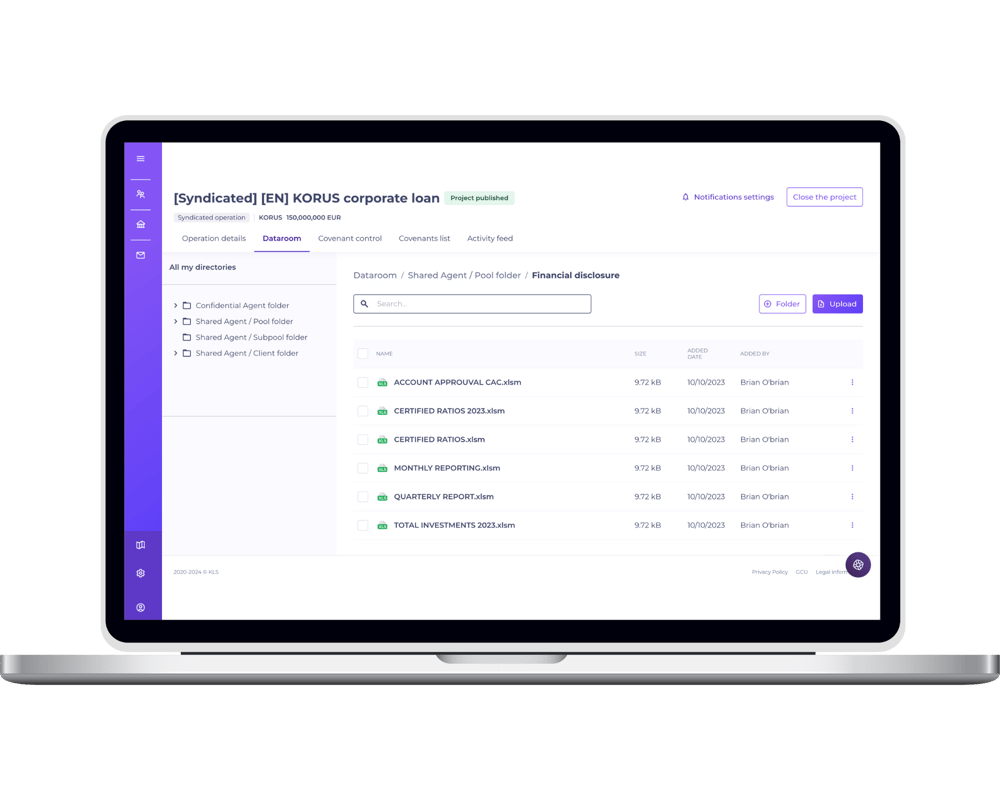

Built-in collaboration

Corporate finance actors need a trusted platform to exchange with their ecosystem: lenders, partners and customers.

Debt Tracking allows you to safely and easily connect on the one hand with your partners (pool) and, on the second hand, your clients (borrowers / issuers).

Less is more

Spend less time on low value-added tasks and more on either managing numerous operations or delivering additional care to your customers.

Pro-tip: with Debt Tracking, you could be doing both ;-)

Dataroom

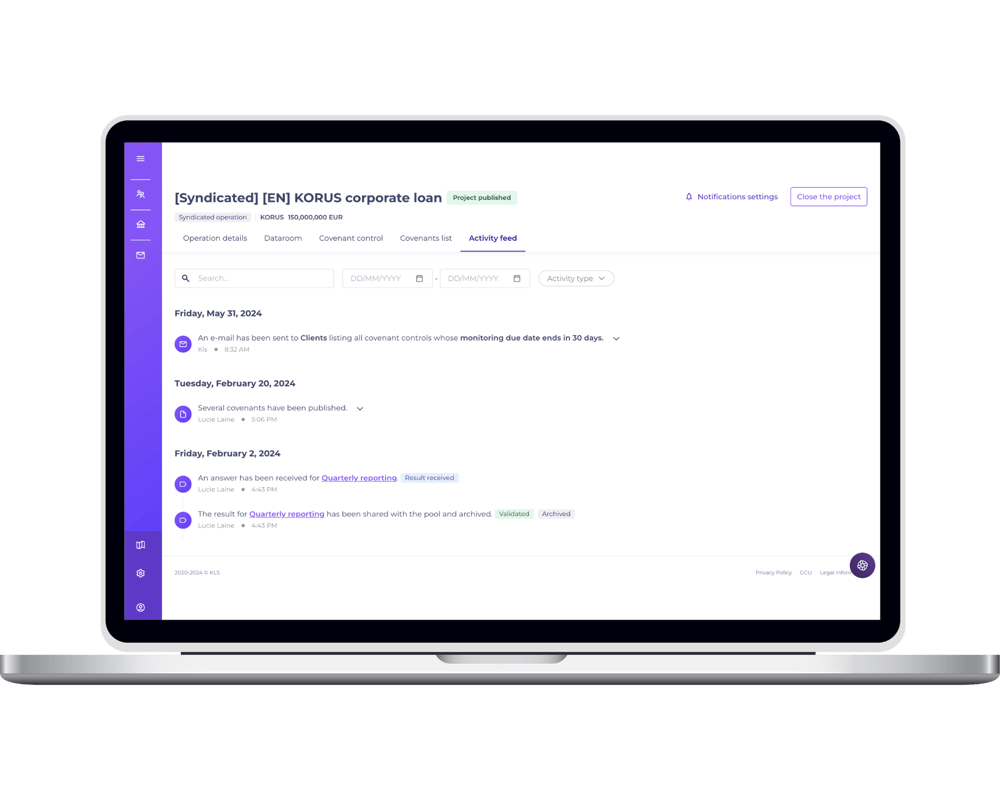

Notifications & Reminders

Commitments monitoring

Track covenants/commitments, ratios, ESG criteria or margin impact, etc.

Portfolio management

Collaborative platform

Data export

What they say

“With the Kls platform, I can keep track of my entire debt portfolio, whether I'm an agent or a participant. Never had all the information in one place before, but wouldn't continue to work without it, now.”

Adam Scanlan

Head of Complex Financing

"To meet our goals, and the group's strategy, we had to deploy new financings indexed to ESG criteria, without having any idea of how to monitor them over time, or how to provide proof of the due diligences or the impact on margins. In the end, with 1 tool, we can do more than before, without any new resources."

Tara Johnson

Corporate Finance Manager