Manage your commercial real estate financing transactions

Track the LTV of the commercial real estate assets in your portfolio, their GHG emissions and their EPDs over time, to meet the challenges of your scope 3 assessment and your Net Zero trajectory.

ContextIn line with the objectives of the Paris Agreements, all stakeholders are now required to focus on a low-carbon transition to reduce greenhouse gas (GHG) emissions. To this end, everyone must define a strategy with the ultimate aim of reducing GHG emissions as close to zero as possible, referred to as the “Net Zero Carbon” objective. As key players in the energy transition, banks have a natural responsibility to monitor and supervise indicators relating to their financing of GHG-emitting projects. Within the commercial real estate sector, a greater understanding of portfolio impacts and the ability to initiate and manage decarbonisation are among the most significant challenges faced. These objectives mean that new monitoring and management requirements apply to all new financing projects and to existing holdings. It is therefore essential to adapt processes and tools to meet these challenges. |

What to expect from this feature?By using Kls to monitor your real estate financing portfolio, you will be able to :

|

Creating a real estate asset tracking transaction in Kls

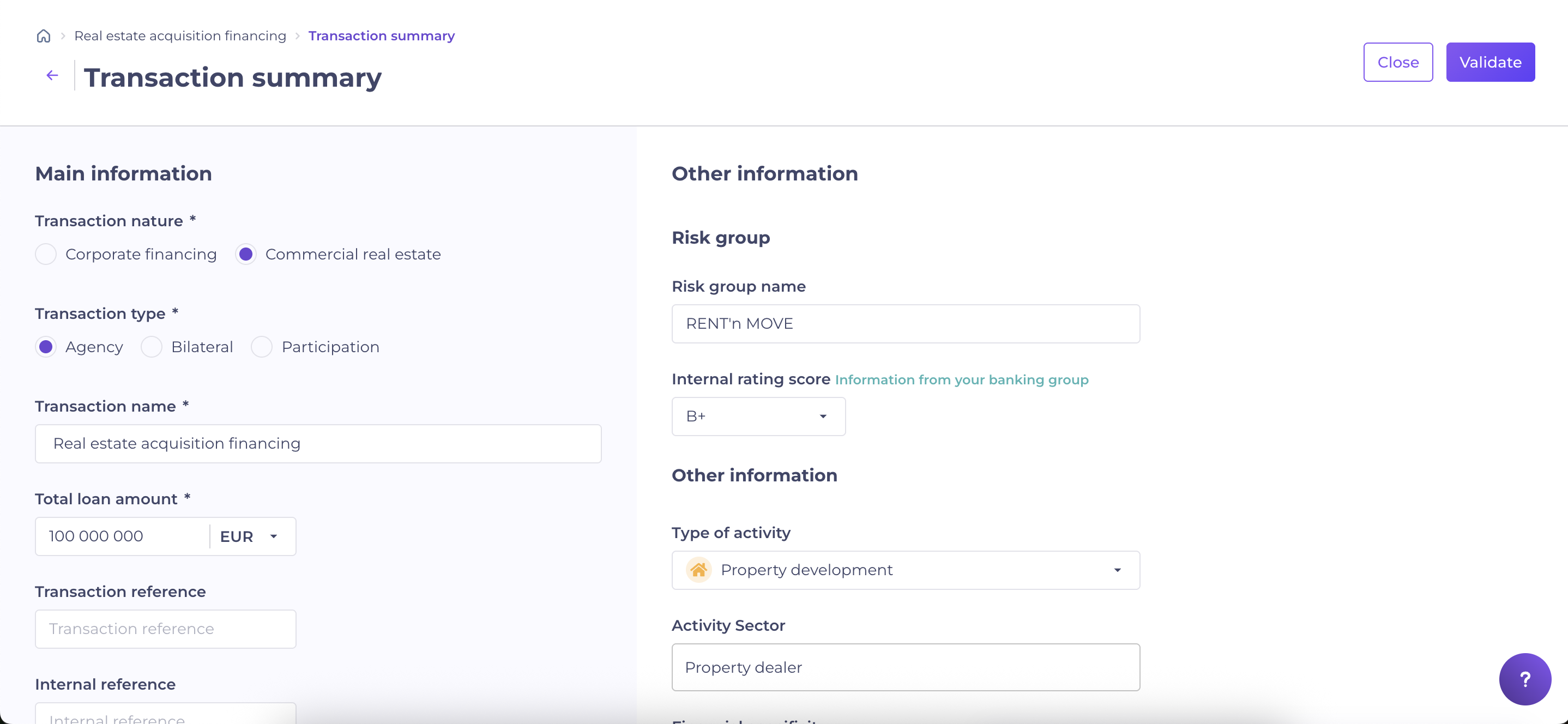

The workflow is similar to the Corporate Finance tracking transaction one. When creating a new transaction, you may choose either the “Corporate Financing” or “Commercial Real Estate” path.

Choosing the appropriate path enables you to segment Real Estate and Corporate Finance transactions with specific tags, thereby facilitating filtering and data processing following export.

The new creation path contains the familiar screens from traditional tracking, enhanced with fields tailored to the requirements of commercial real estate financing.

Key features include:

1. Transaction summary

Immediately after creating your transaction, you’ll be directed to the “Transaction details” tab.

To begin detailing your real estate financing, modify the “Transaction summary” section to enter the contract dates and financing particulars.

In this path, you will find fields including:

- Transaction nature: choose whether the transaction is real estate or corporate financing.

Note:You can change the nature of the transaction even after creation, useful for transferring “untagged” real estate transactions to the new path or correcting an error.

- Real estate account manager: differentiate between your primary account manager and the Agency account manager, if necessary.

- Customer category: access a dropdown list to segment customers.

- Financing specificity: building on the classic path, this section now includes options specific to real estate financing.

2. Client information

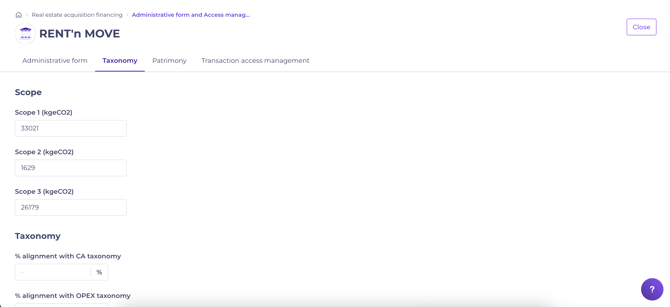

Additional information about customers can be centralised in the commercial real estate workflow.

Two tabs are provided: Taxonomy and Patrimony.

- Taxonomy: enter and save information for each client relating to Scopes 1, 2, and 3, as well as taxonomy alignment percentages.

- Patrimony: record the value and surface area of each customer’s assets.

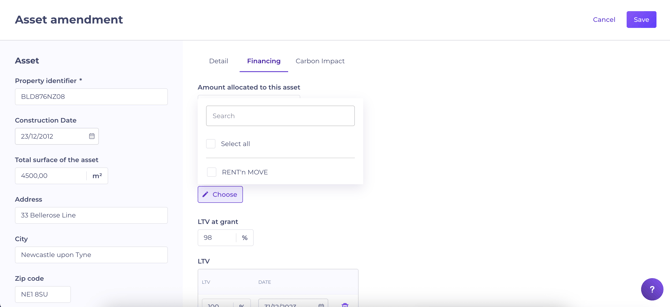

3. Adding an asset

Commercial real estate tracking in Kls Desk introduces another data block dedicated specifically to “Assets”.

In your transaction details tab, once you have completed the customer and financing tranche information, you will be invited to add the asset(s) linked to your financing transaction.

For every asset created, the information includes:

- Asset detail: surface area, construction details, address, land registry, destination, and rental income.

- Asset financing: allocated amounts, affected tranches, changes in LTV (Loan-to-Value) and timing of asset valuations.

"Client(s) attached to the asset" enables to assign the relevant borrower(s) to the appropriate asset(s) in your transaction.

This step is essential for correct data export. See the article on data export

- Asset's carbon impact:

Overview of financed emissions, environmental certifications, carbon intensities, and a history of all EPC (Energy Performance Certificate) assessments and their expiry dates.

Conclusion

With the broad range of use cases possible in Kls Desk (including credit pool management, bilateral financing, ESG monitoring, syndicated loan participation, and commercial property management), you can provide your teams with a tool that streamlines their daily activities; automating time-consuming tasks, facilitating the centralisation and export of vital information, and turning traceability and risk management goals into an easy, routine task.

All of this consolidated information within Kls Desk will enable you to save valuable time in managing your portfolio; especially in real estate, and demonstrate your capacity to provide information effortlessly to showcase your commitment to Net Zero trajectory goals.