You are looking for :

Managing ESG-indexed credits

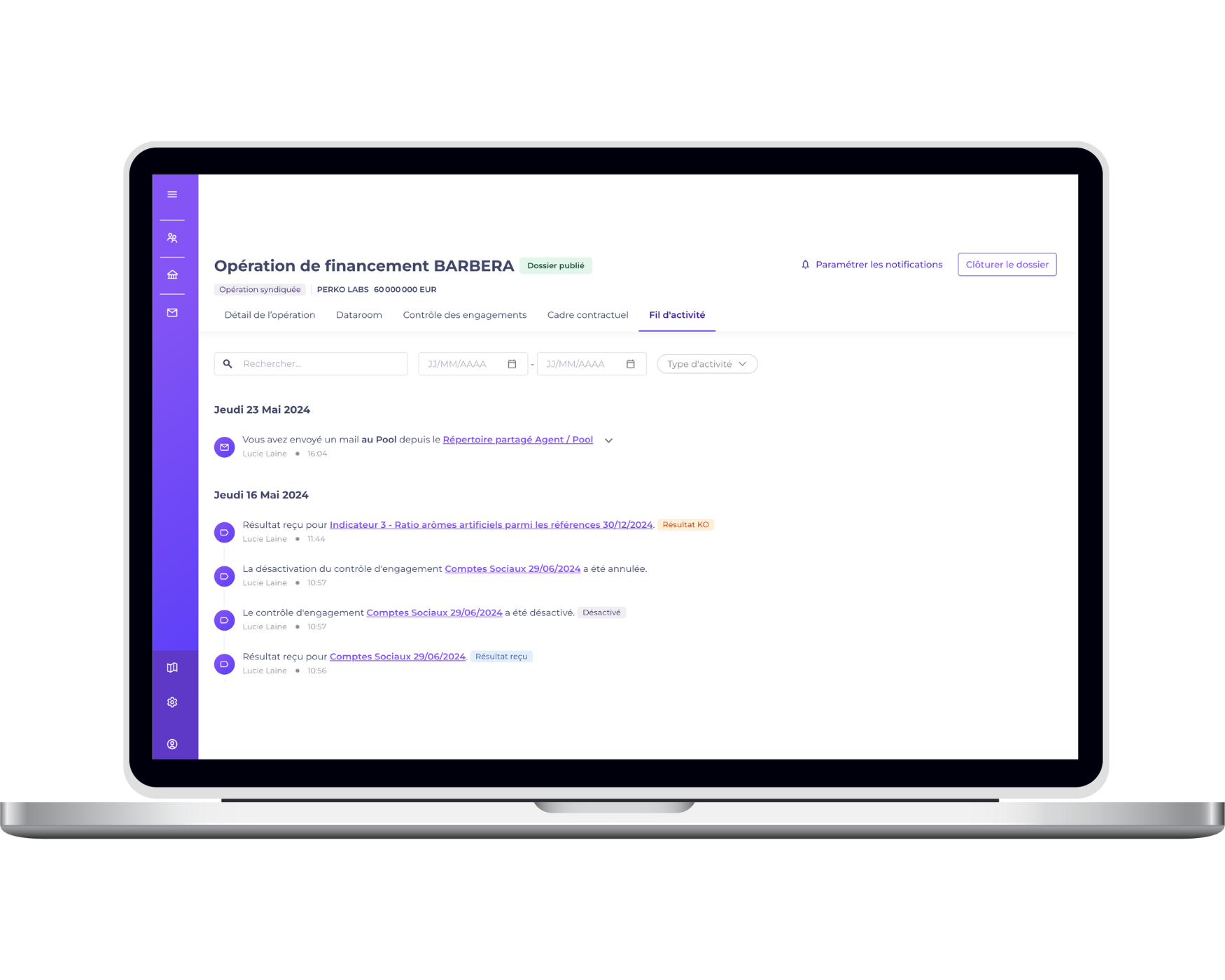

With Debt Tracking, you can quickly equip your business lines with a dedicated ESG criteria monitoring tool.

Some advantages of the application :

Easy response to KPIs

At each control period, collect all the documentation you need via a mirror interface between the ESG Agent and its client(s).

Automatic alerts

Thanks to the automatic alert system, you and your stakeholders are informed when a deadline is about to arrive.

Centralized management

Combine ESG monitoring with existing financial commitments.

Traceability and reporting

Ensure complete traceability and easily generate reports to meet regulatory requirements.

Sustainable operations

Go even further by supporting your customers with green loan offers and impact credits.

Shall we show you?

Discover the Debt Tracking application, to manage your corporate finance operations, or request a demo.

Customers

They testify

"Our bank's strategy is to increase the number of ESG financings we contract. We were finding it difficult to achieve these objectives, as the additional burden of monitoring new types of extra-financial covenants made it impossible to be diligent in monitoring, especially with the margin variations that ESG criteria can induce. Finally, with a single tool, we can do more than before, without additional resources."

Astrid Lorenzo

Corporate Finance Manager

Want to find out more?

Discover the Debt Tracking application, to manage your corporate financing operations.